Blog

Methods for Conceptual Capital Cost Estimation

Conceptual capital-cost estimates are important for assessing the economic viability of proposed projects, but their usefulness depends on understanding how to appropriately apply the estimates.

Global Coal Demand Peaks

Global coal demand hit a record 8.77 billion metric tons in 2024, led by China and India, while the U.S. and ...

Constellation to Acquire Calpine for $16.4 billion

Constellation has announced an agreement to acquire Calpine Corp. for approximately $16.4 billion in cash and ...

BOEM Moves Forward with Gulf Offshore Wind Leases

The Bureau of Ocean Energy Management (BOEM) has announced a Determination of Competitive Interest for two Wind ...

Record Breaking Growth in Q3 for Clean Energy in the U.S.

The American Clean Power Association's latest Clean Power Quarterly Market Report highlights a record-setting Q3 ...

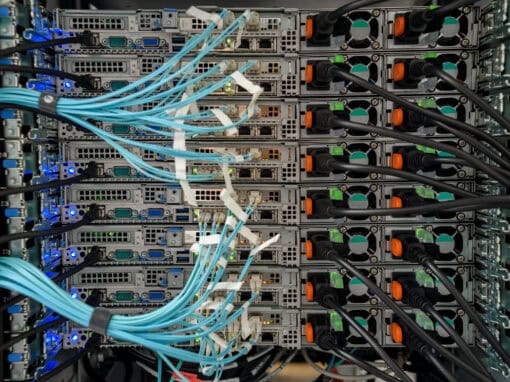

Datacenter demand moves to the Midwest

The rapid growth of data centers in the Midwest, such as Microsoft’s $3.3 billion complex near Racine, Wisconsin, ...

No results found.