By Clayton T. Baumann, PE, CCP, ASA | evcValuation

Click HERE to download a PDF version of this article

Introduction

Insurance Appraisals: what are they, what purpose do they serve, and why are they important? Risk managers, insurance industry professionals, and property owners alike should be able to answer all three questions at length and understand the value of a current, accurate, and reliable insurance appraisal. Further, they should be knowledgeable of the educational background, experience level, and credentials of reputable appraisers who can provide such insurance appraisals. This will assist in properly setting property insurance limits and reduce the financial risk of being under-insured.

Insurance Appraisal Basics

Definitions

What is an appraisal—more specifically, an insurance appraisal? In the insurance industry, “insurance appraisals” or “insurable value” are two common terms, yet there are differences in what these terms mean in different industries.

Per the American Society of Appraisers, an appraisal is “…an unbiased opinion of value of an identified property based upon the investigation and analysis of pertinent data and the application of appropriate analytical techniques.”[1] Further, the Uniform Standards of Professional Appraisal Practice (“USPAP”) defines an appraisal as “the act or process of developing an opinion of value.”[2]

Insurance appraisals, specifically, are developed based on the industry term replacement cost new (“RCN”), considered to be synonymous with reproduction cost new), defined as “the cost of reproducing a new replica of a property on the basis of current prices with the same or closely similar materials, as of a specific date.”[3] As the definition states, an estimate of RCN is not truly an opinion of value, but rather a cost estimate. Another industry term commonly interchanged with RCN is insurable value. As stated in the Appraisal of Real Estate, “the value of an asset or asset group that is covered by an insurance policy has been known as the insurable value, even though the amount is more accurately an indication of cost.”[4] Although the insurance industry may refer to an estimate of RCN as an insurance appraisal, USPAP clearly states that an estimate of RCN for insurance purposes is not considered an opinion of value and thus is not a true appraisal.[5] However, to be consistent with insurance industry references, an RCN analysis and insurance appraisal are considered synonymous herein.

In the event of a loss, an insurance policy generally states it will pay to repair or replace the damaged assets, up to the limit of the policy, based on RCN. If the insured decides not to repair or replace the damaged assets, actual cash value (“ACV”), defined as “the cost to repair or replace the damaged property with materials of like kind and quality, less depreciation of the damaged property,”[6] will be used as the basis of any payments.[7]

The remainder of this article focuses specifically on developing estimates of RCN for insurance purposes. Further, this article addresses setting property insurance limits and does not address business interruption insurance values.

Purpose

What purpose does an insurance appraisal serve? According to the American Society of Appraisers, “Insurance appraisals are required to establish a value for insurance coverage to indemnify the insured against loss. . . . The insurable value is of concern to owners, lessors, lessees, insurers, agents, and brokers.”[8] Generally, insurance appraisals should serve the following purposes:

- Provide accurate and reliable estimates of RCN

- Assist in setting property insurance limits

- Provide confidence to property owners and underwriters when insuring an asset

- Serve as an integral tool for companies to limit financial risk in the event of a catastrophic loss

Insurance Appraisal Process

The insurance appraisal process includes several key components including: determining scope, requesting necessary information, completing a site inspection, developing an RCN analysis, and writing a narrative report.

Determining Scope

The first step in the insurance appraisal process is determining the scope. This is typically completed prior to executing a letter of engagement for completing the appraisal analysis. Defining the scope includes verifying the actual assets to be appraised, confirming the assets to be excluded from the analysis, identifying the definition of value, and establishing the reporting requirement. It is the responsibility of the owner to verify with their insurance underwriter and convey to the appraiser which assets are owned and, therefore, the subject of the insurance appraisal, as well as any assets that should be excluded from the analysis. The assets and costs typically excluded or limited for insurance purposes may include, but are not limited to, the following:

- Demolition, debris removal, excavation, and filling

- Foundations and other below-grade assets

- Indirect costs during construction including interest, insurance, and taxes

- Land

- Intangible assets and working capital

- Licensed Vehicles

- Consumable supplies

- Chemicals, raw materials, and/or finished product inventories

- Spare parts

- Company records

With respect to an insurance renewal, it is also the responsibility of the owner to verify the definition of value, RCN or ACV, with their insurance broker. Another aspect that should be verified with the owner, broker, and possibly the insurance underwriter is the level of detail required in the report. Some property owners and insurers require minimal detail, which could include RCN values for major asset groups, while others require a significant level of detail down to individual assets like pumps, motors, etc. The appraiser must understand the importance of working with the property owner to fully understand the level of detail required.

Request for Information

Once the scope is defined, an information request, which includes all information anticipated to be required to complete the insurance appraisal, is developed and sent to the client. Requested pieces of information could include, but may not be limited to, the following:

- Current statement of insurable values

- Fixed asset listings

- Machinery and equipment lists

- Electrical one-line diagrams

- Process and instrumentation diagrams

- Recent cost records for capital upgrades

- Plot plans and maps

- Building drawings

During the RCN analysis process, it is likely that additional information beyond what was initially requested will be required.

Site Inspection

While a site inspection is not required to complete an insurance appraisal, it is highly recommended.[9] Only a limited understanding of the subject assets can be obtained by reading and looking at plot plans. Further, the site inspection is an opportune time to ask questions to the operators and maintenance personnel at the subject property. The site inspection is ideally performed after a majority of the requested information has been provided by the client in order to give the appraiser adequate knowledge of the subject property. Further, it will allow the appraiser to start the RCN analysis and develop questions that could be best answered during the site inspection. It should be noted that some industrial facilities, such as power plants, refineries, petrochemical facilities, and the like, require security clearances prior to a site inspection, and additional authorization is likely required to take photos while on site. Also, safety orientations are commonly required upon arrival at such facilities. Once the site inspection is underway, the appraiser may complete some or all of the following tasks, and possibly others, depending on the scope of the analysis:

- Verify accuracy of diagrams and drawings

- Verify manufacturer, rating, and capacity of major mechanical and electrical machinery and equipment

- Verify locations of major mechanical and electrical machinery and equipment

- Take photos of all major assets

- Verify quality and construction type of buildings and structures

- Measure dimensions of buildings and structures

RCN Analysis

The development of the RCN involves analyzing all documents provided and information gathered during the site inspection. When developing the RCN for the subject property assets, various cost information sources are referenced, including, but not limited to, the following:

- RSMeans Cost Manuals

- Marshall & Swift (“M&S”)

- Richardson Cost Engineering Manuals

- Engineering New Record

- Subject asset ledger

- Compass International Estimating Yearbooks

- Government studies and sources

- Recent cost records for capital upgrades

- Manufacturer and vendor quotes

- Government and industry studies

Further, various methodologies may be employed in the RCN analysis, including but not limited to the direct pricing method, cost-to-capacity method, and trending method.

Quantity Survey/Direct Cost Method

The quantity survey/direct cost method utilizes current pricing along with detailed estimates of material quantities, building components, and pieces of machinery and equipment that comprise a facility, including all labor, design, and engineering required to replace a facility. Current costs are referenced from vendor quotes, various pricing manuals, recent capital project records, and manufacturer quotes which are used to build up the RCN. While this can be one of the most accurate methods to employ in an RCN analysis, it can be one of the most time consuming and limiting if adequate information on the subject property is not available.

Cost-to-Capacity Method

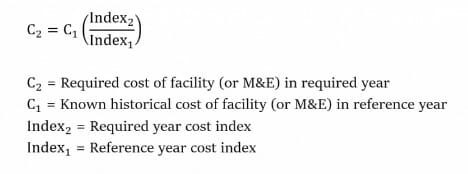

The cost-to-capacity method is an order-of-magnitude cost estimation tool that uses historical costs and capacities to develop current cost estimates for an entire facility or a piece of machinery or equipment (“M&E”). The basis of the cost-to-capacity method is that the costs of facilities, or pieces of machinery and equipment, vary non-linearly with capacity or size. Specifically, cost is a function of capacity or size raised to an exponent or scale factor.[10] The governing equation is as follows:

The main advantage of the cost-to-capacity method is its relatively easy application. It can be applied to quickly develop reasonable order-of-magnitude cost estimates for many different types of industrial facilities and M&E. However, an appropriate scale factor that is representative of the assets in question must be applied to yield reliable results.

Trending Method

Commonly used and reliable cost indices that can be applied in the trending method can be found in the majority of the aforementioned cost sources. While the trending method is straightforward and can yield reliable RCN results, it should be approached with caution. The older the historical costs, the greater potential they have to diminish the accuracy of the RCN estimate. Additionally, the accuracy of the historical costs should be verified. There are numerous reasons why historical costs in asset ledgers or continuing property records may not be accurate, the most notable being past mergers or acquisitions of the subject assets which result in true historical costs being replaced by allocated purchase price figures. Lastly, the cost indices applied in the analysis should appropriately represent the actual assets to which they are applied.

Narrative Report

Once the RCN analysis is complete, the narrative report is developed. The effective date of the report is the last day of the site inspection. As previously noted, the reporting requirements and level of detail should have been discussed during the scoping phase of the engagement. Typically, one or more drafts are circulated to the property owner[12] to allow the opportunity to ask questions, provide comments, and give necessary feedback. Once the narrative report is finalized, the property owner typically includes the report in their submission to renew the insurance policy or revise the existing insurance limit.

Risk of Inaccurate Insurance Appraisals

There are significant financial implications when inaccurate or outdated insurable values are used to set property insurance limits. If insurable values are overstated, a company likely will end up carrying too much insurance and paying unnecessary premiums as a result. Conversely, if insurable values are understated, a company will likely be underinsured and would be in a potentially devastating financial situation if a catastrophic loss occurs.[13] In 2017, the record number of catastrophic weather events in the U.S. and across the globe resulted in an estimated $330 billion in related losses, of which 60% were estimated to be uninsured.[14] Further, per a study by Marshall & Swift, it is estimated that 75% of commercial businesses are underinsured by 40% or more.[15]

In most cases, an inadequate property insurance limit is a direct result of not obtaining a current and accurate insurance appraisal. Further, inadequate property insurance limits frequently start to develop in soft insurance markets, when recent losses have been minimal. In soft insurance markets there is more competition, which may result in underwriters being more accepting of outdated insurable value figures from insureds. During such soft insurance markets in particular, insureds should not become complacent in assuming their insurable values are accurate and reliable. An understanding by insureds of changes in construction and material costs is critical in determining the need for a current appraisal. If an appraisal is completed during times of stagnant material and construction cost changes, it may be acceptable to forego updating the appraisal for several years. In such cases, it is common practice for insureds to inflate insurable values using cost indexes for up to three years before getting an update. However, in times when construction and material costs are highly volatile, an update of the appraisal may be required every year or two.

Obtaining Accurate and Reliable Insurance Appraisals

Several factors should be considered when engaging an appraiser to ensure accurate and reliable insurable value results. The appraiser should have a relevant educational background—for example, many industry-leading insurance appraisers have technical or engineering backgrounds. The appraiser should also have extensive experience in developing detailed RCN analyses for the property type that is the subject of the insurance appraisal analysis. Various appraisal and cost estimating credentials also can provide assurance of the appraiser’s professional knowledge, such as the Accredited Senior Appraiser (“ASA”) designation from the American Society of Appraisers and the Certified Cost Professional (“CCP”) designations from AACE International. Further, the firm that the appraiser is associated with should be reputable, include support staff, and employ internal quality controls to ensure the accuracy and reliability of the RCN analysis. An insurance appraisal by an experienced and qualified appraiser from a reputable firm will be readily accepted by major insurance carriers, provide reassurance to underwriters during the policy renewal process, and very likely reduce property insurance rates and the all-in cost of insurance.

Conclusion

Insureds are responsible for determining the appropriate amount of property insurance. Thus, it is vital to have a current and accurate insurance appraisal on hand for setting property insurance limits and to minimize the financial risk of an insufficient limit in the insurance policy. An insurance appraisal developed by a reputable appraiser will accomplish this goal, will readily be accepted by underwriters of major insurance carriers, and will likely reduce property insurance rates and the all-in cost of insurance. Further, understanding the insurance appraisal process will provide confidence to insureds during the insurance underwriting process.

Endnotes

- American Society of Appraisers, Valuing Machinery and Equipment: The Fundamentals of Appraising Machinery and Technical Assets, 3rd edition (2011), 506.

- Appraisal Standards Board of the Appraisal Foundation, Uniform Standards of Professional Appraisal Practice, 2018–2019 edition (2017), 3.

- American Society of Appraisers, Valuing Machinery and Equipment: The Fundamentals of Appraising Machinery and Technical Assets, 3rd edition (2011), 557.

- Appraisal Institute, The Appraisal of Real Estate, 14th edition (2013), 65.

- Appraisal Standards Board of the Appraisal Foundation, Uniform Standards of Professional Appraisal Practice, 2018–2019 edition (2017), 335.

- American Society of Appraisers, Valuing Machinery and Equipment: The Fundamentals of Appraising Machinery and Technical Assets, 3rd edition (2011), 505.

- If ACV is the basis of an insurance appraisal analysis then developing an estimate of ACV would most likely be considered an appraisal, as opinions of depreciation including physical and potentially functional obsolescence could be considered.

- American Society of Appraisers, Valuing Machinery and Equipment: The Fundamentals of Appraising Machinery and Technical Assets, 3rd edition (2011), 21.

- Insurance appraisals completed without an inspection are typically referred to as desktop analyses.

- Kenneth K. Humphreys, Jelen’s Cost and Optimization Engineering (New York: McGraw-Hill, Inc., 1991), 382.

- Ibid., 383-386.

- The property owner may also circulate the draft report to the insurance broker and/or underwriter for comments.

- Marsh & McLennan Agency, “The Property Insurance Seesaw: The Importance of Accurate Values,” June 10, 2008, http://cambridgeunderwriters.com/wp-content/uploads/2013/05/The-Property-Insurance-Seesaw.pdf.

- Michelle Kerr, “The Growing Insurance Gap Is A Serious Threat to Us All,” Risk and Insurance, April 9, 2018, https://riskandinsurance.com/critical-coverage-gap/.

- “Keeping insurance values up to date,” The Travelers Indemnity Company (2013). https://www.travelers.com/iw-documents/business-insurance/national-property-ITV-CP-6487.pdf.

This article was previously published in the MTS Journal.