By Kevin Reilly, ASA | evcValuation and Clayton T. Baumann, PE, CCP, ASA | evcValuation

Click HERE to download a PDF version of this article

Introduction

This paper discusses issues related to the application of the three approaches to value when valuing a complex property such as a cogeneration plant. A background is given with a description, history, and pertinent factors related to the operations and economics of cogeneration plants and their affect on value. The development of the sales comparison, income, and cost approaches to value are discussed and main valuation methodologies identified on how to derive a reliable indicator of value from each on a consistent basis. A correlation of the three approaches to value is then discussed which identifies potential strengths and weaknesses of each approach and how to arrive at a reliable conclusion of value.

Description and History

Cogeneration, also known as combined heat and power (“CHP”), is an efficient and cost-effective way to generate electrical and thermal energy through the sequential use of a fuel source.1,6 Natural gas is the most prominent fuel source used in modern cogeneration plants, but coal and biomass fuels also are used. The thermal energy produced by a cogeneration plant can be in the form of steam, hot water, or hot air, or it can be a combination of the three.[1] The electrical and thermal energy produced can be consumed on-site or distributed and sold to third parties. The increased efficiency realized by a cogeneration plant results in the consumption of 10% to 30% less fuel as well as a reduction in pollution emissions.[2] Today, in the United States, CHP saves more than 1.9 quadrillion British thermal units (“Btus”) of fuel and 248 million metric tons of carbon dioxide (“CO2”) emissions annually.[3]

Cogeneration is a concept that has been around since the late 1800s. In 1900, 59% of electrical generation in the United States was derived from on-site generation at industrial facilities, most of which were cogeneration plants. The development of the US power generation and transmission industry as a result of favorable economics and increased regulatory factors led to the decline of on-site electrical generation and cogeneration plants. By 1977, on-site electrical generation fell to just 4% of US electrical generation.[4] In 1978, the Federal Energy Regulatory Commission (“FERC”) passed the Public Utility Regulations Policy Act (“PURPA”). PURPA exempted many cogeneration plants from being regulated as utilities and had a primary goal of creating a new class of nonutility electrical generators to promote conservation of electrical energy.[4] Plants that met the requirements of PURPA were identified as qualifying facilities (“QFs”). As part of PURPA, electric utilities were required to interconnect with, buy power from, and sell power to cogeneration plants at reasonable rates. This guaranteed a market for the QFs, thus making investment in cogeneration plants more attractive for the private sector.[5][6] Today, cogeneration provides only approximately 9% of the electrical power in the United States. However, this could be on the rise as the US Department of Energy’s (“DOE”) goal is to increase cogeneration to 20% of the total generation capacity in the United States by 2030, which could save an estimated 5.3 quadrillion Btus of fuel annually.[7]

Although cogeneration plants account for only a small proportion of total US electrical generation today, they are an integral part of industrial facilities in many US industries. Manufacturers account for the largest percentage of cogenerators, at 40%.8 Industries that rely heavily on cogeneration plants include paper and pulp, chemical manufacturing, food processing, and petroleum refining.[9]

Cogeneration Operations and Economics

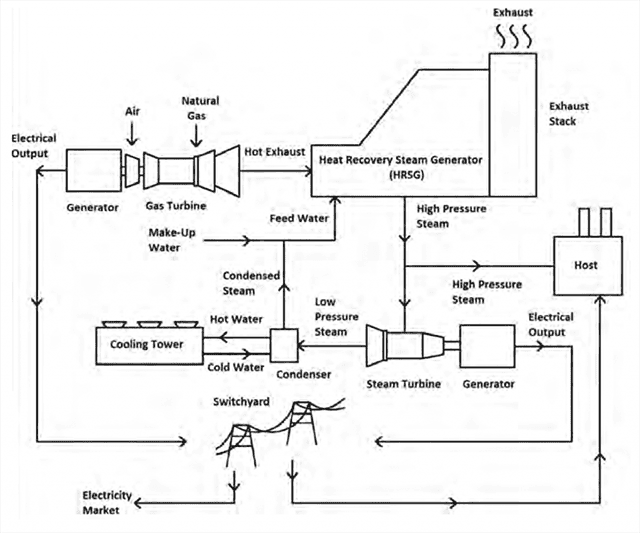

As mentioned previously, the electrical and thermal energy produced by a cogeneration plant can be used on-site or distributed and sold to third parties. The electricity that is not consumed on-site is typically sold to electric utilities, independent power producers, or industrial facilities. Typically, if a cogeneration plant is part of a larger industrial facility, such as a refinery, the majority, if not all, of the electrical and thermal energy produced is consumed on-site. However, in some instances, cogeneration plants are stand-alone facilities constructed to supply third-party industrial facilities with electrical and thermal energy and, thus, consume only minimal amounts of the electrical and thermal energy they produce on-site. In order to minimize inefficiencies with the transport of thermal energy, a cogeneration plant must be located strategically within or near the facility to which it is supplying thermal energy.[10] The consumer of the thermal energy, whether part of the same facility as the cogeneration plant or a third-party facility, is referred to as the “thermal host” or simply the “host.” Below is a simplified diagram of a cogeneration plant supplying a host with thermal steam and electrical energy in addition to selling electrical power in the open market or grid.

Typically, cogeneration plants are designed to be “base-load” or “must-run” in order to meet the thermal requirements of the host. The thermal energy supplied by a cogeneration plant is the most important output and requires very high availability and reliability so that none of the industrial processes to which it is supplying thermal energy to are interrupted. This causes cogeneration plants to have far less control of start-ups or shutdowns as compared to a plant generating only electricity. Also, it limits the opportunities for many cogeneration plants in two ways: their ability to increase generation to supply excess power to the grid in order to capture attractive electricity prices, and their ability to ramp down generation in order to possibly purchase power at a cheaper price than it can be produced. In some cases, depending on the structure of the electricity market, cogeneration plants are designed to regularly supply excess electrical energy to the grid. In determining whether it is economical to design a cogeneration plant to supply excess power to the grid, the most significant factors to consider are the price of electricity available in that specific market as well as the base load thermal requirements of the host.[11]

Another factor affecting the operations and economics of a cogeneration plant is the seasonality of the host’s industry. Most industries are cyclical; this causes fluctuations in the demanded output of electrical and thermal energy on an annual basis. These cyclical fluctuations cause operational inefficiencies due to the fact that cogeneration plants are designed to serve the thermal load of the host.

Established operational contracts for the sale of electrical and thermal energy also affect the operations and economics of a cogeneration plant. These contracts primarily include power and thermal purchase agreements with the host and power purchase agreements with other third parties. In a scenario where a cogeneration plant is supplying electrical and thermal energy to a host, the existing contracts are critical to its operations; typically, a cogeneration plant supplying a host would not exist as a going concern without these contracts.

Approaches to Value

The market value of a cogeneration plant is determined by considering the three approaches to value, which include the sales comparison, income, and cost approaches. Each approach is analyzed to determine its applicability to the specific property being appraised, based on the nature of the property, the nature of the market and industry in which it competes, and the availability of data. To value cogeneration plants, the economics and operations (discussed previously) are analyzed and applied in each approach. Analysis and application of the approaches are discussed in the subsequent sections.

Sales Comparison Approach

The sales comparison approach develops value through an analysis of recent sales that have occurred in the market. An indication of market value for a cogeneration plant is derived by reviewing the sale prices of cogeneration plants that have sold in an active, open market and are similar in nature to the subject. These sales prices must be drawn from actual transactions involving comparable cogeneration plants. Sales prices of comparable cogeneration plants are analyzed, compared to the subject plant, and then adjusted to reflect differences in size or capacity, market conditions or time, age, and location between the subject and the comparables. This is not an exhaustive list; other adjustments may need to be made.

As previously mentioned, cogeneration plants are usually specifically designed to meet the electrical and thermal requirements of the host, which makes each cogeneration plant highly unique. In many cases, this can make it difficult to apply adjustments in the sales comparison approach in an effective and reliable manner. When applying adjustments, it must be verified that comparable sales are truly comparable. It should be noted that the difficulties associated with valuing a cogeneration plant via the sales comparison approach should not deter application of this approach. It can still yield a reliable indication of value and, at a minimum, provide a range of values for the subject plant.

Oftentimes, in valuing a cogeneration plant, the purchase price of solely the tangible assets is what is to be determined. In order to arrive at the purchase price of only the tangible assets, deductions must be applied to each comparable sale or the sales comparison approach indicator of value. Deductions typically are made for intangible assets, inventories, and working capital. For a cogeneration plant supplying electrical and thermal energy to a host, the intangible assets would primarily include electrical and thermal purchase agreements, which can contribute positive or negative value. Other intangible assets that must be valued and deducted may include the trained and assembled workforce and management team, computer software, emission credits, and operating manuals and procedures. After making the appropriate adjustments, the result is the value of just the tangible assets.

Income Approach

The income approach measures value as the present worth of future monetary benefits anticipated to be derived from ownership of the assets. These monetary benefits are based on the income stream expected to be available to the owner of the assets. The present worth of the future monetary benefits is measured by taking into account the duration and pattern of the projected income stream and the risk inherent in realizing that income stream. The duration and pattern of the projected income stream are based on projections that take into consideration the type of property, its remaining economic life, and future market conditions. In order to derive a market value, intangible assets such as contracts and emission credits are excluded from the analysis and a pure, market-based forecast is derived. The risk element is recognized by discounting the projected income stream at a rate commensurate with the risk perceived by a prospective investor in the subject compared with other investment opportunities. The discount rate is the result of a prospective investor’s evaluation of the relative risk of the investment under review. The income approach is the primary method buyers and sellers use to make an investment decision.

For a cogeneration plant, cash inflows are forecast from income resulting from the sale of electrical and thermal energy. Cash outflows are forecast from costs associated with fuel, variable and fixed operating expenses, future capital expenditures, and any required influxes of working capital necessary to support growth and sales revenue. Future capital expenditures or reserves for replacement are those that are necessary to support or maintain current operations plus any environmental capital investments. They do not include any expenditure that materially alters existing facilities, except for government mandated environmental additions or changes to the plant.

Typically, forecasts for market prices of electricity and fuel are available from various public and private published sources. In a cogeneration plant, the price paid by the host for thermal energy delivered is typically the price of the fuel used to produce the thermal energy plus an adder for other fixed and variable costs. For example, in a cogeneration plant that is supplying thermal steam energy and is fueled by natural gas, the price paid for steam is typically the price of natural gas plus an additional cost for fixed and variable expenses associated with producing the thermal steam. Therefore, the price of steam can be forecast based on the future price of natural gas. Future fixed and variable operating expenses can be forecast through analyzing historical operations. Future capital expenditures for a complex property, such as a cogeneration plant, typically are forecast by owners of the plant in a short- to mid-term capital expenditure budget. For years in the forecast past the capital expenditure budget, it is reasonable to take a percentage of the plants replacement cost new (“RCN”). This percentage represents the minimum capital investment required to sustain the plant’s operations. This percentage is generally in the range of 1% to 3% of RCN.

The developed forecast is projected over a period that is determined by the level of confidence in the accuracy of the projected cash inflows and outflows. Some industries are highly volatile; as such, only a small degree of certainty is given to cash inflow and outflow projections that are forecast more than two to three years into the future. Typically for a cogeneration plant a 10- to 15-year forecast period is applied to a debt-free net cash flow. This reflects what potential purchasers of the plant would consider in making decisions regarding a possible purchase and represents the income stream that debt and equity holders would realize. Depreciation can be calculated using modified accelerated cost recovery system (“MACRS”) schedules.

As previously mentioned, the projected income streams are discounted at a rate commensurate with the risk perceived by a prospective investor. A weighted average cost of capital (“WACC”) analysis is applied in order to derive the appropriate discount rate. The discount rate for a cogeneration plant is developed by analyzing other market participants in the power generation industry that own cogeneration facilities. The level of debt and equity in the guideline companies’ capital structure is used to develop a typical capital structure for the power generation industry. In addition, the nondiversifiable risk, or beta, associated with each guideline company is analyzed to develop a typical beta for the power generation industry.

Two methods typically are applied to develop the cost of equity: the capital asset pricing model (“CAPM”) and the bond-yield-plus-risk-premium, or build-up, method. It may be necessary to add additional risk in the development of the cost of equity to account for the lack of diversification and, hence, the additional risk of ownership inherent in the single plant being valued. This risk is not exhibited in the guideline companies used to develop the capital structure and beta because the guideline companies typically own portfolios of plants and thus have more diversified risk than ownership of a single plant. Another factor that can require application of an additional risk factor is the economic environment of the host’s industry. Because cogeneration plants also gain revenues from the sale of thermal energy, any downturn in the host’s industry that could result in reduced demand for thermal energy could greatly affect the profitability of a cogeneration plant, thereby making it a riskier asset to own.

The cost of debt is developed by considering bond ratings for the guideline companies and the general financial rating and status of the power generation industry. Typically, the cost of debt is high and can be represented by Baa bond yields, which capture the inherent risk associated with owning a single plant. After developing the cost of debt and equity, the WACC is calculated by weighting the cost of debt, tax-affected to reflect the deductibility of interest expense, and the cost of equity by the developed industry capital structure indicated by analysis of the guideline companies. The WACC is then applied to the forecast debt-free cash flow.

This discounted debt-free cash flow establishes the value of the business enterprise of the subject cogeneration plant. Machinery and Technical Specialties (“M&TS”) Committee of the American Society of Appraisers defines a business enterprise as “all tangible assets (property, plant, equipment, and working capital) and intangible assets of an operating business. It represents the value of the total invested capital of the business, composed of long-term debt and stockholders’ equity.”[12]

In order to develop the value of the tangible assets, to be consistent with the sales comparison approach, deductions must be made for working capital and intangible assets. In analyzing the guideline companies used in the development of the WACC, a typical level of net working capital can be developed. As mentioned previously, typically a market-based forecast of future cash flows is developed independent of any current contracts that are in place and emission credits that are owned by the plant or a parent company. Therefore, the intangible asset value of contracts associated with a cogeneration plant, including thermal and power purchase agreements, and emission credits is not part of the calculated business enterprise value and does not need to be deducted. However, other intangible assets do exist in the developed business enterprise value that do need to be valued and deducted; these include the assembled and trained workforce and management team, computer software, and operating manuals and procedures, among others.

After deducting the values of the working capital and intangible assets, the resulting value indicated by the income approach represents the value of solely the tangible assets, including land, land improvements, buildings, and machinery and equipment.

Cost Approach

The cost approach is used to estimate value based on the current cost of the subject asset, less an allowance for existing depreciation or loss in value from physical deterioration, functional obsolescence, and economic obsolescence. In the cost approach, an analysis is made of the capacity and utilization, physical condition, and operating characteristics of the actual plant being appraised in comparison with a modern replacement plant. This approach requires an analysis of the economics of the industry in which the plant competes as well as technological advances in that industry. Hence, the appraiser must be familiar not only with the physical attributes of the plant, but also with its capabilities, technical attributes, and economics.

While buyers and sellers do not typically develop the cost approach as they do an income approach, they are familiar with the cost of new construction, the physical attributes and condition of the plant being reviewed, the operating characteristics of the subject in comparison with a modern plant, and the economics of ownership. The appraiser utilizes all of this engineering and market information to develop an indication of value via the cost approach. The cost approach is the only indicator of value that identifies and values only the unique assets included in the valuation; it does not include any intangible assets.

When calculating the current cost of a complex property such as a cogeneration plant, the RCN of a modern replacement plant with like utility is developed. The M&TS Committee of the American Society of Appraisers defines a replacement cost new as “the current cost of a similar new property having the nearest equivalent utility as the property being appraised.”[13] After RCN has been developed, deductions then must be applied for all other forms of depreciation, which includes physical deterioration, functional obsolescence due to excess operating expenses, and economic obsolescence.

In determining depreciation, a deduction for physical deterioration is applied. This deduction represents loss in value due to the wear and tear experienced by the property as a result of past service experience and maintenance practice; exposure to the natural elements or the production area atmosphere; the less obvious internal defects due to vibration and operating stress; and the effects of prolonged shutdowns, accidents, and disasters. Estimates of physical deterioration are developed through discussions with plant engineers, a personal inspection of the plant, and consideration of age and life expectancies. An objective analysis can be performed by expressing physical deterioration as a percentage of cost by calculating the effective age of the group of assets, establishing the average service life of the assets, and then calculating an age/life relationship.

Next, a deduction is made for functional obsolescence due to operating inefficiencies, which is sometimes referred to as “operating obsolescence.” New technologies typically result in better operating and control systems and improved performance that decrease generating heat rates, labor requirements, maintenance costs, environmental operating costs, and emissions costs. All of these contribute to making the modern equivalent plant more valuable. The primary form of operating obsolescence inherent in a cogeneration plant is energy efficiency as measured by the heat rate. Heat rate can be defined as the amount of energy (in Btus) required to produce 1 kWh of electrical output. To measure operating obsolescence inherent in a subject plant due to energy efficiency, the heat rates of a modern replacement plant available in the market as of the appraisal date are compared to the heat rate of the subject plant. The difference in heat rates is used to calculate the amount of excess energy used on an annual basis to generate electricity and steam. This amount of excess energy is then applied to the price of the fuel source to derive a monetary penalty. This monetary penalty is then applied over the remaining useful life of the plant, summed, and discounted to present value using the discount rate developed in the income approach less any added additional risk factors. In the cost approach, the present value penalty is applied as a deduction for operating obsolescence.

Economic obsolescence is then estimated. Economic obsolescence can be defined as a form of depreciation, or an incurable loss in value, caused by unfavorable conditions external to the property. Economic obsolescence may be caused by such factors as reduced demand for the product; overcapacity in the industry; dislocation of raw material supplies; increasing costs of raw materials, labor, utilities, or transportation, while the selling price remains fixed or increases at a much lower rate; legislation; and environmental considerations. Specifically for a cogeneration plant, economic obsolescence can be investigated through analysis of electrical generating industry gross margins, inutility, and competition, and the industry of the host that is being supplied thermal and electrical energy from the subject. Knowledge of the power generation industry and the industry of the host is necessary to develop this analysis. It is significant to note that factors leading to economic obsolescence may appear at any time in the property’s life.

Finally, a deduction is made for necessary capital expenditures, which are a form of functional and economic obsolescence. Necessary capital expenditures are expenses mandated by a government agency for continued operations. For a cogeneration plant, a typical major necessary capital expenditures would include environmental emission control equipment, which reduces the amount of pollution released into the atmosphere. These expenditures would be incurred by a potential purchaser of the subject plant, as well as by the current owner. Typically, the subject plants capital project forecast is used and analyzed to identify necessary capital expenditures. Then the present value of the total identified necessary capital expenditures is calculated by applying the previously developed discount rate less added additional risk factors. While necessary capital expenditures can comprise a significant amount of invested capital, they typically do not contribute any added utility to the cogeneration plant and therefore do not contribute any positive value to cash flows. In fact, the additional installed equipment typically results in an increase in operating expenses, which negatively affects the cash flows of the plant. Necessary capital expenditures allow cogeneration plants to legally remain operating.

After all forms of depreciation are developed and deducted from the RCN for the subject plant the value of land as if vacant and available for development is added. The land value as if vacant and available for development takes into account any known remediation costs. The result is an indication of value for the cogeneration plant by the cost approach.

Correlating the Approaches to Value

After applying the sales comparison, income, and cost approaches to value, the indicated values from each approach are correlated to a final opinion of value. Factors considered when correlating the three indications of value are discussed in the following paragraphs. It should be noted that even if all approaches are developed, more weight may be given to one approach if that approach is determined to be a more reliable indicator of value than the others.

The sales comparison approach reflects the actions of buyers and sellers in the market. Using the sales comparison approach, an indication of market value is derived by reviewing the sales prices of comparable properties that are similar in nature to the subject and that have sold in an active, open market. The sales prices of comparable properties are analyzed, compared with the subject plant, and then adjusted to reflect differences that exist between the subject and the market comparables. It is important to note that the comparable sales must be investigated to ensure the sales data used reflects a property that is actually comparable to the subject. For a complex property such as a cogeneration plant, the unique nature of each comparable plant can sometimes make it difficult to apply appropriate adjustments. Furthermore, given that cogeneration plant transactions often include electrical and thermal purchase agreements, it can be difficult to quantify the appropriate level of required adjustment to arrive at the purchase consideration of the desired group of assets to be valued. However, a thorough objective analysis can still yield a reliable indication of value and, at a minimum, a range of values.

The income approach reflects actual investor expectations of a particular property operating in a specific industry. Future cash inflows and outflows are projected to develop a forward-looking analysis, which reflects the financial rewards of ownership as well as the risks involved in applying a market-based discount rate to derive future cash flow projections. Because projections are market based, slight variations in the market can greatly affect the indication of value. In order to be a reliable indicator of value, the income approach should be supported by market.

The cost approach develops the value of a property based on the cost currently required to construct a modern replacement plant of equal utility less all forms of depreciation plus the value of the land associated with the plant. Forms of depreciation include physical deterioration, functional obsolescence, and economic obsolescence. To develop a cost approach for a complex property such as a cogeneration plant, the appraiser must be knowledgeable of the economics and technology in the electrical generating industry as well as the industry of the host being supplied thermal and electrical energy. The result of the cost approach is a subject-specific indication of value that typically is reliable.

When fully developed, the three approaches to value reflect all attributes of the market and allow for the development of a complete and supportable conclusion of value. In correlating the three approaches to value, the appraiser must determine the amount of reliance to place on each of the calculated value indications. In the valuation of a complex property such as a cogeneration plant, the appraiser must use experience and judgment to closely consider the appropriateness of the approaches developed, the quality of the data utilized, and the quantity of the market data investigated in concluding a final opinion of value.

Conclusion

Cogeneration is a critical part of many industries around the United States and the world. The operational efficiencies realized by cogeneration plants provide great benefits to both industries and consumers. Cogeneration plants use less fuel and emit lower amounts of pollution when producing electrical and thermal energy than stand-alone electrical and thermal energy facilities. When valuing a cogeneration plant, an appraiser must consider all three approaches to value and have a firm grasp of the operations and economics of the electrical generation industry as well as the industry of the host. All analyses must be applied in a concise and consistent manner to arrive at a reliable, market-based conclusion of value for the desired group of assets.

Endnotes

- California Cogeneration Council, 2004.

- Fitzpatrick & Lutwen, 2011.

- ICF International, 2010.

- Limaye, 1987.

- IHS, 2006.

- Butler, 1984.

- US Department of Energy, Office of Energy Efficiency and Renewable Energy, n.d.

- Fitzpatrick & Lutwen, 2011.

- Butler, 1984.

- Canadian Electricity Association, 2011.11Meidel, n.d.

- Meidel, n.d.

- Machinery and Technical Specialties Committee of the American Society of Appraisers, 2011, p. 172.

- Machinery and Technical Specialties Committee of the American Society of Appraisers, 2011, p. 41.

References

Butler, C. H. (1984). Cogeneration: Engineering, design, financing, and regulatory compliance. McGraw-Hill Book Company.

California Cogeneration Council. (2004). CCC Fast Facts. Retrieved from http://californiacogenerationcouncil.com/fast facts.html

Canadian Electricity Association. (2011). Cogeneration. Retrieved from http://knowyourpower.ca/electricity-411/electricity-fuel-source-technical-papers/cogeneration/

ICF International. (2010, October). Effect of a 30 percent investment tax credit on the economic market potential for combined heat and power. Washington, DC: Hedman, B., & Hampson, A.

IHS. (2006, February 7). FERC Finalizes Revised Cogeneration Facilities Regulations. Retrieved from http://www.ihs.com/News/utilities/2006/ferc-cogeneration-rules-020706.htm

Fitzpatrick, T., & Lutwen, R. (2011, December 28). Building cogent cogeneration strategies in the US. Cogeneration & On-Site Power Production, 12(6). Retrieved from http://www.cospp.com/articles/print/volume-12/issue-6/features/building-cogent-cogeneration-strategies-in-the-us.html

Limaye, D. R. (1987). Industrial cogeneration applications. Liburn: The Fairmont Press, Inc.

Machinery and Technical Specialties Committee of the American Society of Appraisers. (2011). Valuing machinery and equipment: The fundamentals of appraising machinery and technical assets. (Third ed.). Washington, D.C.: American Society of Appraisers.

Meidel, R. W. (n.d.). Cogeneration – challenges & opportunities: Meeting cogeneration targets in the marketplace. Retrieved from http://www.exxonmobil.com/Europe-English/Files/cogeneration_word.pdf

US Department of Energy, Office of Energy Efficiency and Renewable Energy. (n.d.). Combined heat and power. Retrieved from http://www1.eere.energy.gov/manufacturing/distributedenergy/pdfs/chp_accomplishments_booklet.pdf

This article was previously published in the MTS Journal.